How Politicians & You May Profit Off Of Private Prisons Without Even Knowing It

Popular Institutional Investment Firms Have Large Stakes in Incarceration Companies Which Means You May Too in Your Retirement Accounts

President Donald Trump has promised to crack down on people who have immigrated to this country illegally.

Earlier this year, 46 House Democrats and 12 Senate Democrats voted to enact the Laken Riley Act — which was the first bill Trump signed into law in his second term.

Democratic Senator John Fetterman of Pennsylvania even attended the bill signing in the Oval Office — as a child, his wife Gisele immigrated illegally to this country from Brazil.

Neither Mr. nor Mrs. Fetterman responded to Hunter Index’s interview requests.

The new law requires the detention of unauthorized immigrants who have been arrested or charged with — not convicted of — crimes as minor as shoplifting. Opponents of the law argue that it violates due process rights of migrants.

Incarceration numbers are likely to increase as an effect of the law. The United States already spends over $80 billion on incarceration each year according to the ACLU. In 2022, 90,873 people were incarcerated in private prisons across 27 states and the federal government system.

According to a recent NBC News article, “immigrant detention centers” are already at capacity as of this week, and Immigration and Customs Enforcement (ICE) has arrested 32,809 individuals since Trump’s inauguration.

The private prison industry in the United States — yes, this country has even commercialized incarceration and detention facilities — is dominated by four companies:

GEO Group (GEO),

Core Civic (CXW),

LaSalle Corrections & Jones Lang LaSalle (JLL), &

MTC or Management and Training Corporation, which is privately owned .

MTC said it “cared for nearly 24,000 individuals” in 14 detention facilities nationwide and “more than 80,000 incarcerated individuals” in 17 prisons in 2023.

So, what is in this edition? Since Hunter Index is the most complete and robust database of U.S. politicians’ personal finances, we can give you an analysis of how many politicians will likely profit off an increased incarceration population in the United States.

Goldman, Khanna & McCormick Previously Owned Stakes in The Private Prison Industry

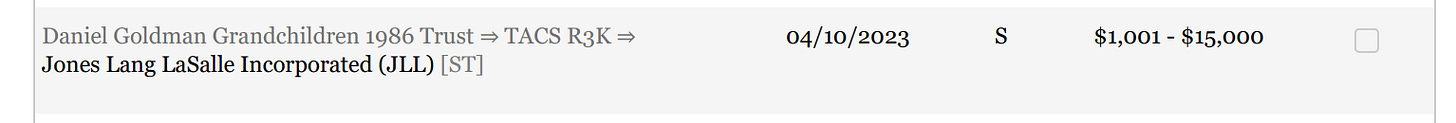

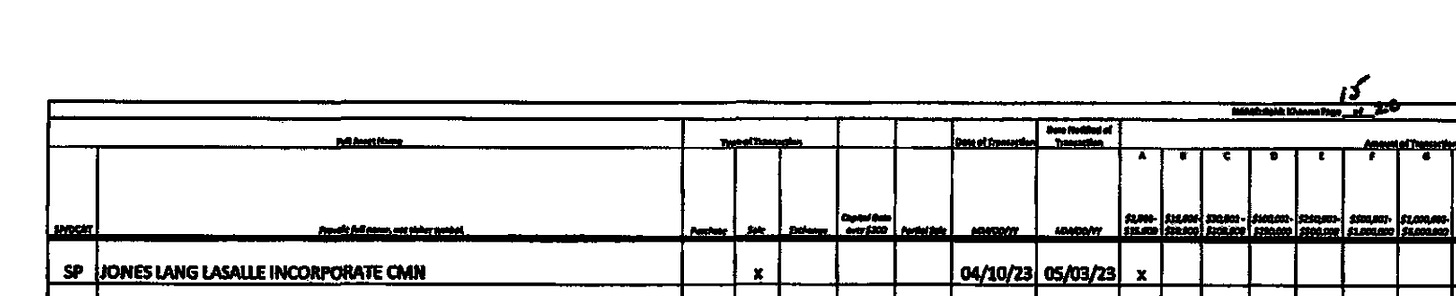

Rep. Daniel Goldman sold his JLL stock worth between $1k and $15k — reportedly at a loss — on April 10, 2023. Don’t worry, he still received more than $9mil in asset-derived income according to Hunter Index.

Rep. Ro Khanna’s wife Ritu Khanna — née Ahuja — sold JLL stock worth between $1k and $15k on April 10, 2023. The stock was not actively managed by any member of the Khanna family and was held in a trust managed independently by advisors and owned solely by Ritu Khanna.

Sen. David McCormick received between $27k and $85k in income when he sold multiple CoreCivic corporate bonds before he won election to the Senate last year.

In an interview with Hunter Index, Rep. Khanna reaffirmed his support for a ban on stock trading by members of Congress and said that his family would always comply with the law including any changes that could come from a stock trading ban.

His wife and dependent children (both under the age of ten) have assets in trusts that her father Monte Ahuja originally set up in the 1990s — well before Rep. Khanna and Ritu were married in 2015.

Unlike his fellow immigrant to northeast Ohio — Sen. Bernie Moreno, Monte Ahuja appears to have actually started from limited means to build his automative parts distribution company in the greater Cleveland Ohio area beginning shortly after he graduated from The Ohio State University. Mr. Ahuja founded Transtar Industries, Inc. in the 1970s and also runs an investment company: MURA Holdings, LLC.

The Khanna family’s wealth is derived almost exclusively from the Ahuja family which created numerous trusts for Ritu and the young Khanna children that are not actively managed by the family.

Let’s Talk About Those Retirement Accounts & Mutual Funds…

Unsurprisingly, politicians rarely direct own stock in these prison companies. However, most of these companies’ stock is owned by institutional investors — like investment firms and banks.

A breakdown of Geo Group, Core Civic and Jones Lang LaSalle ownership by institutional investors (percent):

$GEO: (86.26%) - BlackRock including their IJR fund; Vanguard; Wolf Hill; Fmr LLC; Goldman Sachs; State Street; and others.

$CXW: (88.84%) - BlackRock; Vanguard; River Road; Cooper Creek Partners; State Street; and others.

$JLL: (94.29%) - Vanguard; BlackRock; Fmr; Generation Investment; Morgan Stanley; Edgepoint Investment Group; and others.

In the Hunter Index’s exclusive database of politicians’ personal finances:

$182.6 million is held directly in Vanguard assets;

$57.9 million in Goldman Sachs; &

$6.6 million in BlackRock, and 13 politicians own shares of IJR worth at least $628k.

As we like to be transparent here at Hunter Index, our small personally-held retirement accounts from past employers have assets held or managed by some of these firms.

So What?

Capitalism, Baby! It is nearly impossible in this country’s economic system to even be fully aware of what you are investing in without dedicating your life to researching the portfolio makeup of every single mutual fund, ETF and other assets that may be in your target retirement funds or portfolio.

Remember, even Rep. Khanna told us in an exclusive interview this week that he and his wife are not knowledgeable of every single transaction in their family trusts which they do not manage.

But, that’s a good thing when it comes to our government officials. According to a University of Maryland poll in 2023, approximately 86% of registered voters support a ban on stock trading by members of Congress — this is not a partisan issue.

Like those in the Khanna family portfolio, trusts managed by independent financial advisors could help build the public’s faith in their officials and reduce the possibility for any “insider trading” by politicians.

However, John Q. Public or other readers like you may want to take a deeper look into where your money is actually being invested because you could be profiting off of the detention of legal residents such as Mahmoud Khalil.

Money talks. Ask questions. Whether you agree or disagree in the morality of a for-profit incarceration system, we at Hunter Index believe you should be aware of how your government officials may personally profit from their policy decisions like voting for the Laken Riley Act.

“In The News.” The Columbia University protest leader and legal resident of the U.S. as a green card holder Mahmoud Khalil is being held in the GEO-owned Jena/LaSalle Detention Facility operated by ICE according to public records matching Mr. Khalil’s birth location and year.

The Jena facility is notorious for previously seeing the highest amount of alleged sexual and physical abuse incidents as reported to ICE.

Why Does It Matter?

Please be informed of your politicians’ personal financial information.

That’s our mission at the Hunter Index. We believe it is important for constituents to understand how their government officials’ personal finances may affect their policy making decisions as well as understanding the potential wide disparity between their wealth and that of the people in their home state or district.

Remember our favorite questions: Would you make a decision that costs your family money for the public good? Isn’t that what we ask of our government officials?

Managing Hunter's Political Wealth Index and its exclusive database which makes reporting like this possible is extremely expensive and labor intensive.

Please consider becoming a paid subscriber to help fund this accountability project led by a disabled journalist or share this publication with others.