Dying In Office Pays Off for Members of Congress

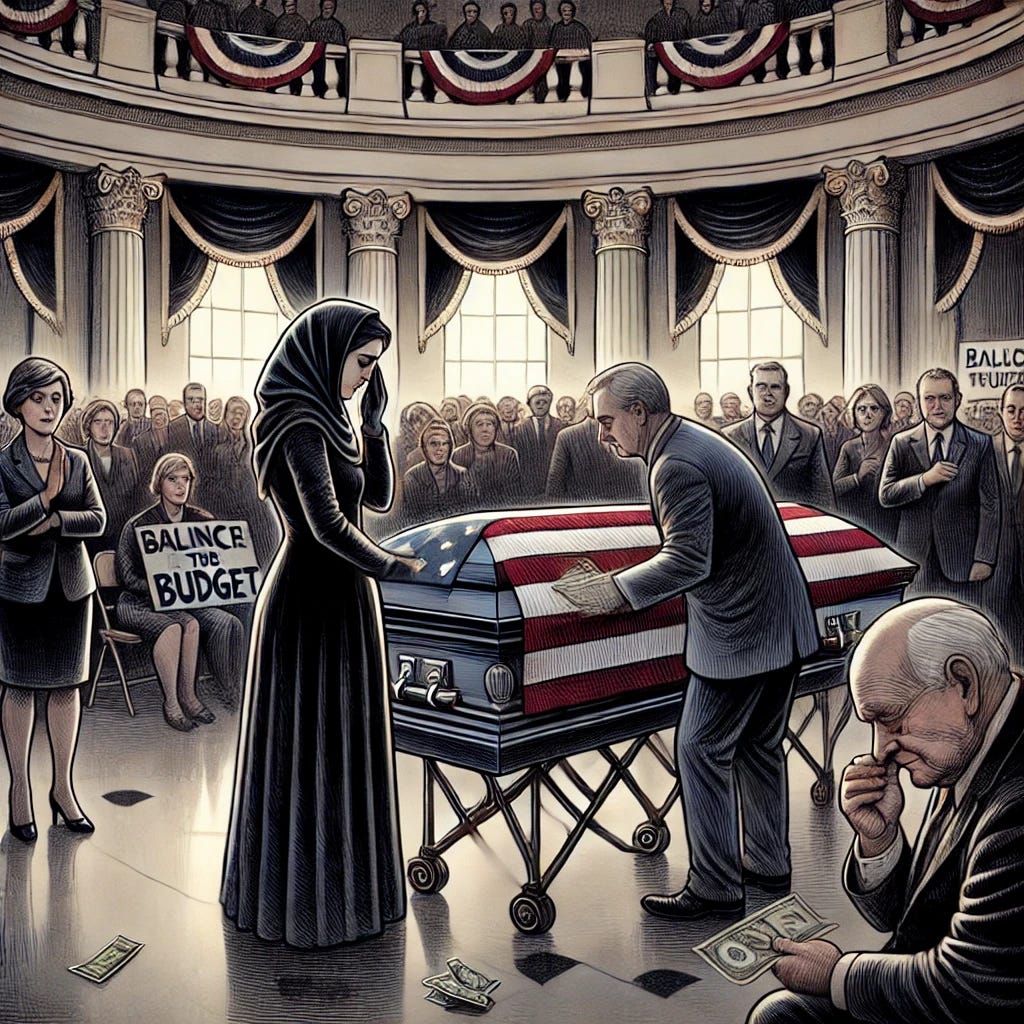

Politicians dying in office has cost taxpayers at least $7 million since 2000.

As yinz all know, we will all die at some point in our lives.

As yinz probably do not know, members of Congress have a financial incentive to pass away while still holding their seat.

Earlier this month, two House Democrats — Reps. Raúl Grijalva and Sylvester Turner — passed away. We recommend reading this stunning obituary of Rep. Grijalva by our peer and former colleague Pablo Manríquez of Migrant Insider.

Dianne Feinstein of California was the most recent senator to die in office back in 2023.

So, what is in this edition?

Hunter Index takes a look at the compensation plan and some of the other benefits for members of Congress beyond their base $174k salary and personal finances normally covered by our reporting.

So, read on to learn about some perks of holding a seat in Congress like their pensions as well as death gratuity gifts to their spouses if they die before retiring or resigning their seat.

Perks for Members of Congress

Members are entitled to certain benefits due to their employment in Congress — just like other employees in various public and private industries.

Death Gratuity Gifts to Widows

Since 2000, 44 members of Congress have died in office.

Congress has a tradition of using public funds i.e. taxpayer dollars to pay out a death gratuity to the deceased member’s family according to the Congressional Research Service:

In the next appropriations bill, an item is typically inserted for a gratuity to be paid to the widow(er) or other next-of-kin, in the amount of one year’s compensation. By statute, a death gratuity is considered a gift.

Hunter Index estimates death gratuities have cost $7.3 million in the last 25 years.

Member Pensions & Retirement Accounts

Employer-provided pensions may be something of the past for most private sector employees who aren’t baby boomers.

However, pensions are still a vital component of the compensation package of and financial incentive for public service workers from your town’s local bureaucrats all the way up to the federal workforce and elected officials at the highest levels of government.

In attempt to keep things concise and simple, we will focus on the laws since 1984.

Specifically, members of Congress are entitled to the following benefits with some stipulations:

Social Security retirement like any other eligible United States citizen.

Federal Employee Retirement Services (FERS) benefits including a employer-provided basic retirement annuity (think pension) and Thrift Savings Plan (think 401(k)).

Additional perks while holding office like death gratuities to surviving heirs; government exchange health insurance options as established by the Affordable Care Act; office budget for staff and official travel expenses; franked mail rights; etc.

Members pay into these systems via:

a 6.2% Social Security payroll tax on their adjusted base salary of $162k, as of 2023;

anywhere from 1.3% to 4.4% tax into the Civil Service Retirement and Disability Fund (CSRDF) depending on when they joined Congress; and

any voluntary contributions — usually maxing out annually at $22k — to their Thrift Savings Plan through which they receive a 5% match from their employer — the federal government.

After serving five years in Congress, members are normally eligible for a FERS pension starting at age 62. If eligible, they can receive their pension earlier if they have enough years of service — like other public sector jobs like civil servants, teachers, judges, police officers and other first responders.

Their congressional pensions max out at 80% of their final salary.

Keep in mind, these congressional pensions are in addition to any other retirement accounts including Social Security and past employer or private plans which are covered by the Hunter Index and its exclusive database.

“There were 619 retired members of Congress receiving federal pensions based fully or in part on their congressional service as of October 1, 2022. Of this number, 261 had retired under CSRS and were receiving an average annual pension of $84,504. A total of 358 Members had retired with service under FERS and were receiving an average annual pension of $45,276 in 2023.” - according to a 2023 CRS report.

So What?

Historically, a few members of Congress try to end the policy of death gratuities to surviving heirs, but the legislation rarely receives any consideration in a committee, let alone an actual vote.

The most recent effort was by Florida Republican Bill Posey in 2021.

The legislation did not receive any cosponsors. Rep. Posey has a modest (for Index members) minimum net worth of $450k and received roughly $10k from his three Rockledge rental properties in his Space Coast, Florida district.

Why Does It Matter?

Please be informed of your politicians’ personal financial information.

That’s our mission at the Hunter Index. We believe it is important for constituents to understand how their government officials’ personal finances may affect their policy making decisions as well as understanding the potential wide disparity between their wealth and that of the people in their home state or district.

Remember our favorite questions: Would you make a decision that costs your family money for the public good? Isn’t that what we ask of our government officials?

Managing the Hunter Index and its exclusive database which makes reporting like this possible is extremely expensive and labor intensive.

Please consider becoming a paid subscriber to help fund this nonprofit led by a disabled journalist or share this article with friends.